Companies can shine a light on financial uncertainty with flash reports

Business owners: Do you often feel like you’re steering a ship through the dark when it comes to your company’s financial performance? Flash reports may help.

News & Insights

Companies can shine a light on financial uncertainty with flash reportsBusiness owners: Do you often feel like you’re steering a ship through the dark when it comes to your company’s financial performance? Flash reports may help.

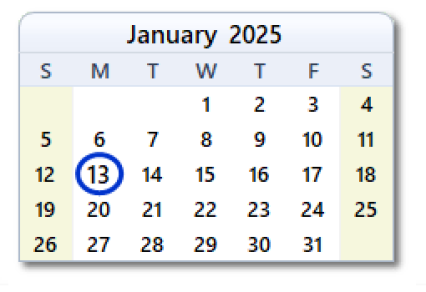

Appeals Court Overturns Injunction; BOI Filing Required with Short ExtensionWe have an important update related to the reinstatement of the BOI Filing requirement. As most of you are likely aware, on December 3, an order was issued granting a nationwide injunction delaying the January 1, 2025 deadline for BOI filings. On December 23, the injunction was overturned—as a result, all applicable reporting companies are required to file BOI with FinCen by January 13, 2025.

The contractor’s role in life-cycle cost analysisConstruction business owners: Have you ever encountered life-cycle cost analysis? Many project owners, especially in the commercial and infrastructure sectors, are engaging in this practice. Here’s what you need to know.

Nonprofit start-ups: Form 1023 or 1023-EZ?New nonprofits must ask the IRS to recognize their tax-exempt status. But should you file Form 1023 or Form 1023-EZ, the easier, less expensive option? Here’s some information to help you decide.

Embrace the future: Sales forecasting for businessesBusiness owners: Is your company adept at sales forecasting? It really needs to be. Here’s an overview of this mission-critical process.

Businesses need to stay on top of their BYOD policiesBusiness owners: If your company’s employees use their personal devices for work, be sure you have a current BYOD policy in place.

What are retained earnings — and why do they matter?Business owners tend to overlook retained earnings on their balance sheets. However, they’re often on external stakeholders’ radar. Here’s a quick overview.

Exit strategy: ESOPs for construction companiesConstruction business owners: Are you looking for help strategizing your succession and choosing a viable employer-sponsored retirement plan? Check out an ESOP.

ESOPs can help business owners with succession planningBusiness owners: Have you ever considered implementing an employee stock ownership plan (ESOP)? Along with serving as a retirement vehicle, an ESOP can help you with succession planning

Family business focus: Taking it to the next levelFamily business owners: Are you ready to elevate the operational sophistication of your company? Here are some ideas to up your game.

Keep your nonprofit’s special event safe and successfulAs in life, so it is with nonprofit special events: Hope for the best but prepare for the worst. This starts with implementing a comprehensive crisis management plan.

What contractors should expect when getting bondedNot every construction business is super familiar with the process for obtaining a performance bond. Here’s a quick overview of how it works. |

© 2025 Mullen Sondberg Wimbish & Stone, P.A.. All Rights Reserved.